Chinese capital flight is accelerating, shaking markets around the world, particularly in Australia where the effect on property prices is notable. In September, net outflows from China reached a staggering $75 billion, a significant increase from August’s $42 billion. Despite an elevated goods trade surplus, the current account showed net outflows, with the goods trade surplus conversion ratio falling to only 19% in September from 38% in August due to continuous depreciation of the currency. The services trade deficit widened to $15 billion from $14 billion, while income and transfers accounts experienced outflows of $7 billion, gaining momentum from August’s $5 billion.

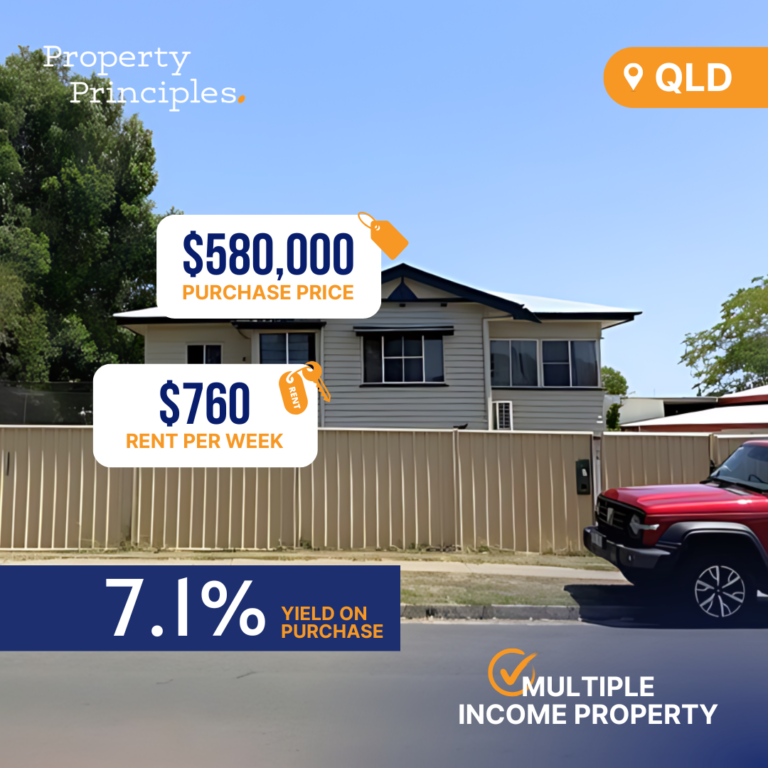

Various factors contribute to these escalating outflows, such as unfavorable interest rate spreads between China and the US, which could indicate continued depreciation and outflow pressures in the future. Another reason could be the depreciation of the Australian Dollar (AUD) against the Chinese Yuan, which has led to increased purchases of Australian property by mainland Chinese investors.

While AUD depreciation provides some appeal to Chinese investors, the AUD has been caught in a tight range with the Yuan for the past eight years. The pair’s movement typically follows the iron ore market, and since 2015, when China’s economic slowdown became apparent, the AUD has mirrored this fall. It seems Australia’s reliance on Chinese property investment and dirt exports remains strong, as successive governments have done little to shift this dependence.

However, recent measures by Beijing to block illegal capital outflows have provided some limited relief to priced-out and homeless Australians. These steps have helped to somewhat slow down the inflow of offshore Chinese money into the domestic property market. Although there is some anecdotal evidence of increased Chinese property investments, reliable data sources still show only a modest uptick.

During Australia’s 2011-15 property boom driven by Chinese investors, the AUD dropped 40% versus the Yuan. This depreciation amplified the appeal of rising capital values for foreign investors. However, this time around, the concurrent fall of both the AUD and the Yuan could act as a deterrent for Chinese investment, as there is no significant currency incentive.

In summary, the accelerating Chinese capital flight has far-reaching effects on global markets, particularly in Australia. Factors such as unfavorable interest rate spreads and depreciation of both the AUD and the Yuan contribute to the increasing outflows from China, significantly impacting the Australian property market. While the Australian government has failed to curb this dependence effectively, Beijing has stepped in to limit illegal capital outflows. Although the currency depreciation may deter some Chinese property investments, it remains essential for the Australian government to take further decisive action to reduce reliance on Chinese capital and secure the nation’s economic future.