Did you know that Australian mortgage holders spend a significant chunk of their working hours just to cover their average monthly home loan repayments? Canstar’s recent study reveals that homeowners repaying the average loan of $584,836 and earning an annual average wage of $72,000 need to dedicate a whopping 135.34 hours or 17.81 days per month to afford their $3,883 monthly loan repayment. That’s equivalent to more than three and a half weeks of work each month!

When it comes to households with dual incomes, the number of hours required to cover the mortgage payment drops to 67.67 per person or 8.9 days per month – still an impressive figure, but notably shorter than for single-income households.

Let’s take a look at how this breaks down by state, including how many working hours each person in a dual-income household would need to put in to cover their home loan repayments.

– New South Wales: 80.58 hours (10.6 days)

– Victoria: 69.36 hours (9.13 days)

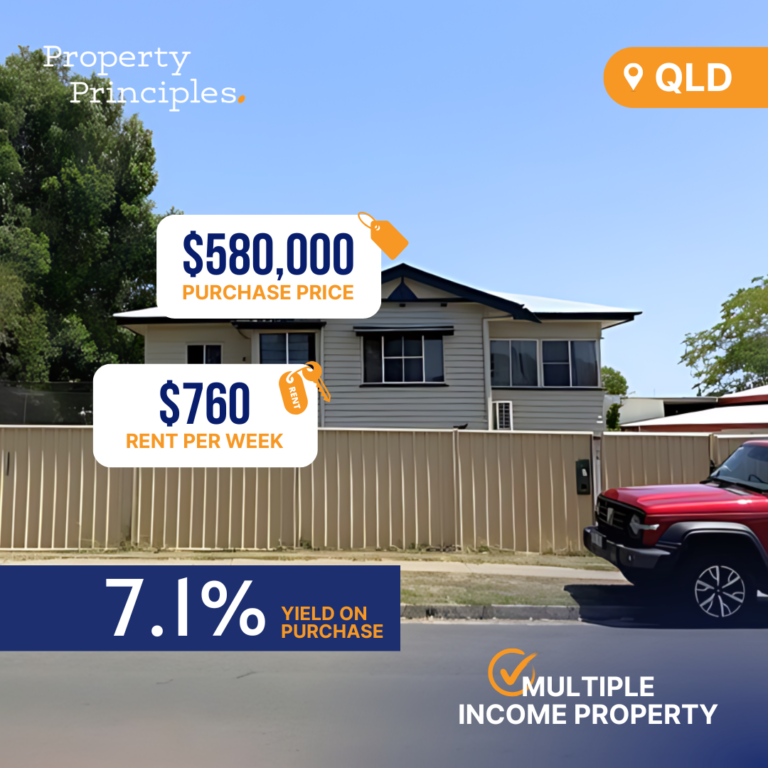

– Queensland: 62.52 hours (8.23 days)

– South Australia: 58.85 hours (7.74 days)

– Western Australia: 51.09 hours (6.72 days)

– Tasmania: 60.86 hours (8.01 days)

– Northern Territory: 47.06 hours (6.19 days)

According to Effie Zahos, Canstar’s Editor-at-Large and money expert, single-income households need to devote a staggering 82% of their monthly working hours to their mortgage repayments. This leaves very little wiggle room for covering other household expenses, like food and utility bills. To put things into perspective; the study found that single-income households would need to work an additional 23 hours, equivalent to three days, just to cover an average monthly grocery bill of $659.

With all these pressures, what can be done to lighten the load and reduce the number of working hours needed to cover basic living expenses?

1. Increase your income: Whether it’s by negotiating a pay rise, finding a higher-paying job, or utilizing the sharing economy platforms, increasing your income can help ease the pressure on your budget.

2. Refinance your mortgage: Swapping your existing customer interest rate of 6.98% for the market’s lowest rate of 5.39% on an average loan of $584,836 could lead to monthly savings of $603 and spare you a substantial $216,969 in interest over your loan’s lifespan.

3. Minimize food wastage: Seek assistance from AI technology like ChatGPT to help you make the most of the ingredients you have by providing recipe recommendations.

4. Monitor your energy consumption: Consider adopting energy-saving habits like washing clothes with cold water, air-drying laundry, and taking shorter showers. Also, check if you’re eligible for any energy rebates or concessions to help lower your bills.

5. Switch providers to save: Sticking to your current insurance or energy provider can end up costing you more in the long run. Canstar’s research suggests that switching your home and contents, car insurance policy, and electricity bill could save you around $2,138 in the first year alone.

Remember, easing the burden of home loan repayments and other expenses requires both strategic planning and proactive decision-making. By following these simple tips, you can effectively lower the number of working hours needed to cover your basic living costs, to enjoy a better work-life balance and financial freedom.